The Big Three of Cash Management Include

The big three of cash management include a accounts. Keep Inventory levels low.

At the time of.

. It also includes a follow-up mechanism that ensures there is faster recovery and will also make the company aware of future contingencies like bad debts etc. Accounts receivable prices and expenses. This is also an important function of cash.

Paying accounts payable sooner. Accounts receivable accounts payable and inventory d. Accounts receivable overhead and inventory b.

A accounts receivable overhead and inventory. B accounts payable accounts receivable and taxes. Following are the principles of Cash management.

An extra fee is charged. 23 The big three of cash management include. If a company were to grant credit indiscriminately without ascertaining.

This sheet tells you the answer to these. 24 Experts estimate that ________ percent of industrial and wholesale sales are on credit while ________ percent of retail sales are on credit. Cash management also known as treasury management is a process that involves collecting and managing cash flows.

It is significant to note that cash management functions as depicted are intimately interrelated and inter-wined. What is Cash Management. The big three of cash management include.

As a result of globalisation and the competitive environment companies are seeking more sophisticated cash management solutions and focusing on standardised processes and strengthening internal controls which will lead to a. 1The basic principles of cash management include carrying more inventory. Optimizing Cash Level.

Credit card acceptance when customer does not have a checking account set up. Each of the four locations in operation are unique to the area we provide our service. Accounts payable accounts receivable and taxes c.

23 The big three of cash management include. Following are the big three of cash management. Reducing excessive amount of cash in hand.

The goal is to manage the cash balances of. 2Restricted cash is normally reported in the notes to the financial statements. As a current or noncurrent asset on the statement of financial position.

C accounts receivable accounts payable and inventoryD accounts receivable prices and expenses. Experts estimate that ________ percent of industrial and wholesale sales are on credit while ________ percent of. Efficient cash management function calls for cash planning evaluation of benefits and costs evaluation of policies procedures and practices and synchronization of cash inflows and outflows.

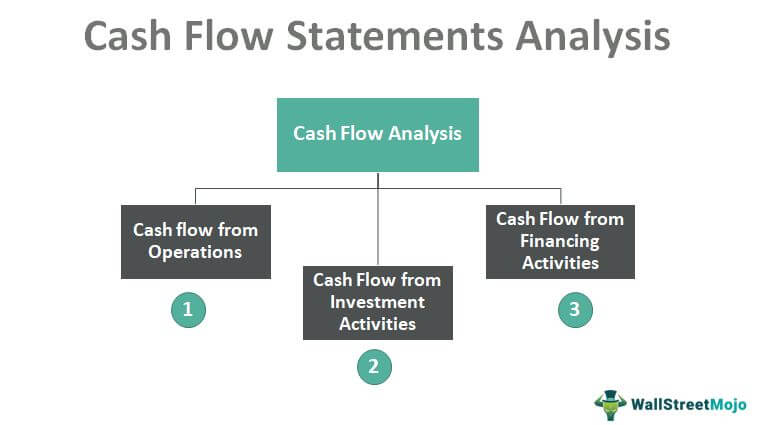

The organization should continuously function to maintain the required level of liquidity and cash for business operations. Furthermore efficient cash management is expected to significantly improve both the profitability and growth of a company. The Big Three Cash Flow Statements These answer the important managerial question do I have enough cash to run my business Income Statements This is the financial sheet that tells you if your company is profitable or not.

Then using changes in the balance sheet usage and receipt of cash is found. Managing Cash Flows. The big three of cash management include.

Account Receivable AR is one of a series of accounting transactions dealing with the billing of customers who owe money to a person company or organization for goods and services that have been provided to the customer. Provide the opportunity to forgo quantity and cash discounts. Cash management is a broad term that refers to the collection concentration and disbursement of cash.

As a non-operating item in the income statement. Managing cash flows that is cash disbursements and receipts at all times. Delay payment of Liabilities.

Accounts receivable accounts payable and inventory. The big three of cash management include ________. A accounts receivable overhead and inventory.

Maintaining the proper flow of cash in the organization through cost-cutting and profit generation from investments is necessary to attain a positive cash flow. The Big Three of Cash Management. By lowering the average collection period for funds you will have more money to use for.

B accounts payable accounts receivable and. The big three of cash management include. How large are my assets.

Chief financial officers business managers and corporate treasurers are usually the main individuals responsible for overall cash management strategies stability analysis and cash related responsibilities. The 5 basic principles of cash management include1- Increase the speed of receivables collection. 3 Cash flow statement.

The cash flow statement displays the change in cash per period as well as the beginning balance and ending balance of cash. The cash flow statement then takes net income and adjusts it for any non-cash expenses. Maintaining optimum balance of cash to meet planned and unexpected expenditures.

Funds are transfer from the customer account to ours electronically. In corporate cash management also often known as treasury management business managers corporate treasurers and chief financial officers are typically the main individuals responsible for. Speed up collection of Receivables.

A accounts receivable overhead and inventory. The Big Three of Cash Management Electronic fund transfers EFT. Areas that offer possibilities for better cash management include accounts receivable accounts payable and inventories.

C accounts receivable accounts payable and inventory. Balance Sheets How much debt do I have. In such a scenario cash managements function will ensure that there is a faster recovery of all the receivables to avoid a probable cash crunch.

Cash Flow Statement Classification Format Advantages Disadvantages More

No comments for "The Big Three of Cash Management Include"

Post a Comment